Vane + Xero

Key Benefits

Formerly known as BillFront, Vane is a financial technology platform offering agile non-dilutive funding solutions to some of the world’s fastest-growing businesses in digital sectors. Driven by deep expertise in both financial services and digital technology, Vane specialises in deploying capital across the digital economy, from advertising technology companies and app developers to e-commerce businesses and online publishers. Vane offers flexible revolving credit facilities including receivables finance, revenue-based finance, and custom-built credit solutions.

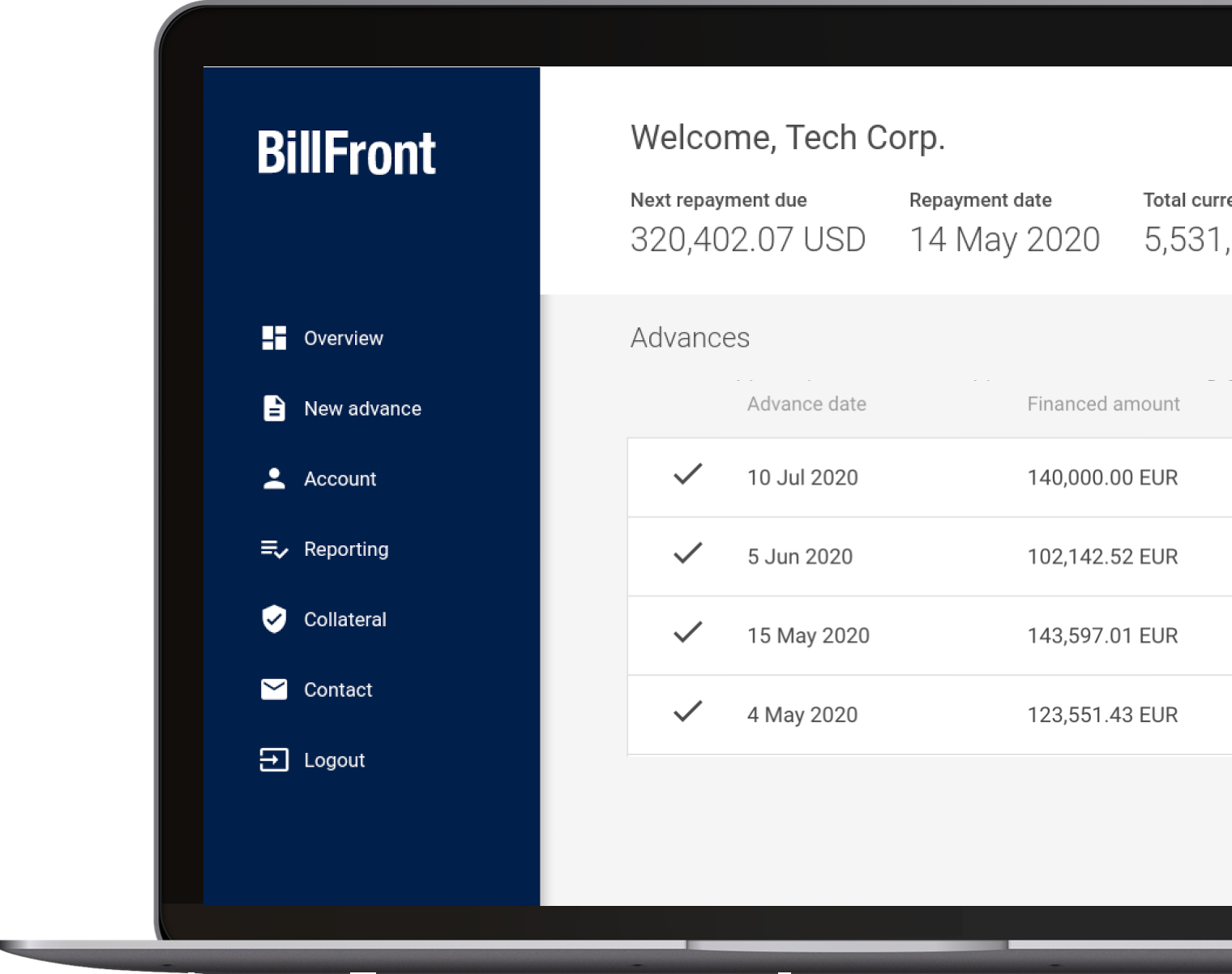

The Vane App helps you to quickly choose your required loan amount from your available line of credit. Loan advances can be drawn for maturities of 60-120 days and can be rolled on a revolving basis for added convenience.

Vane is the perfect partner to support your company’s growth and meet your working capital requirements.

Why Connect Vane to Xero

The benefits of connecting Vane with Xero include:

Simplicity

Connecting the App to Xero is simple and reduces manual work to a minimum. Through the Xero connection Vane receives (read-only) access to all relevant information for providing you with a quote. No complicated forms to fill out and no tedious exchange of information required.

Our receivables financing dashboard is particularly easy to use, thanks to our direct integration with accounting providers.

Real time

Just upload the information through your own user account or submit your invoices with your known accounting software. Xero will connect to it and ensure real-time data transmission.

At the same time, all the relevant loan info can be reported back into Xero, to ensure smooth and timely payout of your requested advance.

What the Vane App Does

The Vane App is easy to use and helps you request your funds within 2 minutes.

The App is specifically designed for all companies from the tech and digital media space with working capital requirements. Vane understands the funding requirements in these Industries and has developed this app to address your financing needs.

The App enables fast financing once the set-up is completed. Loan advances can be drawn for maturities of 60-120 days and can be rolled on a revolving basis for added convenience.

Credit facilities have a minimum size of GBP- equivalent of 150,000 and can be funded in GBP, EUR and USD. We can provide funding of up to 95% of your available accounts receivable.

What Xero Does

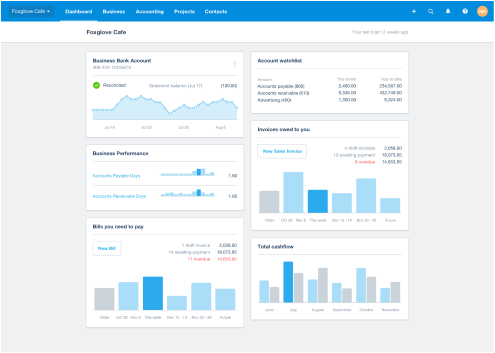

Xero is an online accounting software that lets you run your business easily and efficiently.

See your up-to-date cash position

Know how you’re doing financially with secure daily updates from your bank accounts and a clear visual dashboard.

Get paid faster and improve cash flow

Easily create and send invoices with online payments and automated invoice reminders for faster payment.

Run your business from anywhere

Access your business finances anytime, from any internet-connected device, and use the Xero app for iOS and Android.

Connect and collaborate anytime

Invite your team and your advisors to work with you in real time from home, office, or on the go using the mobile app.

Connect Vane to Xero in 3 Easy Steps

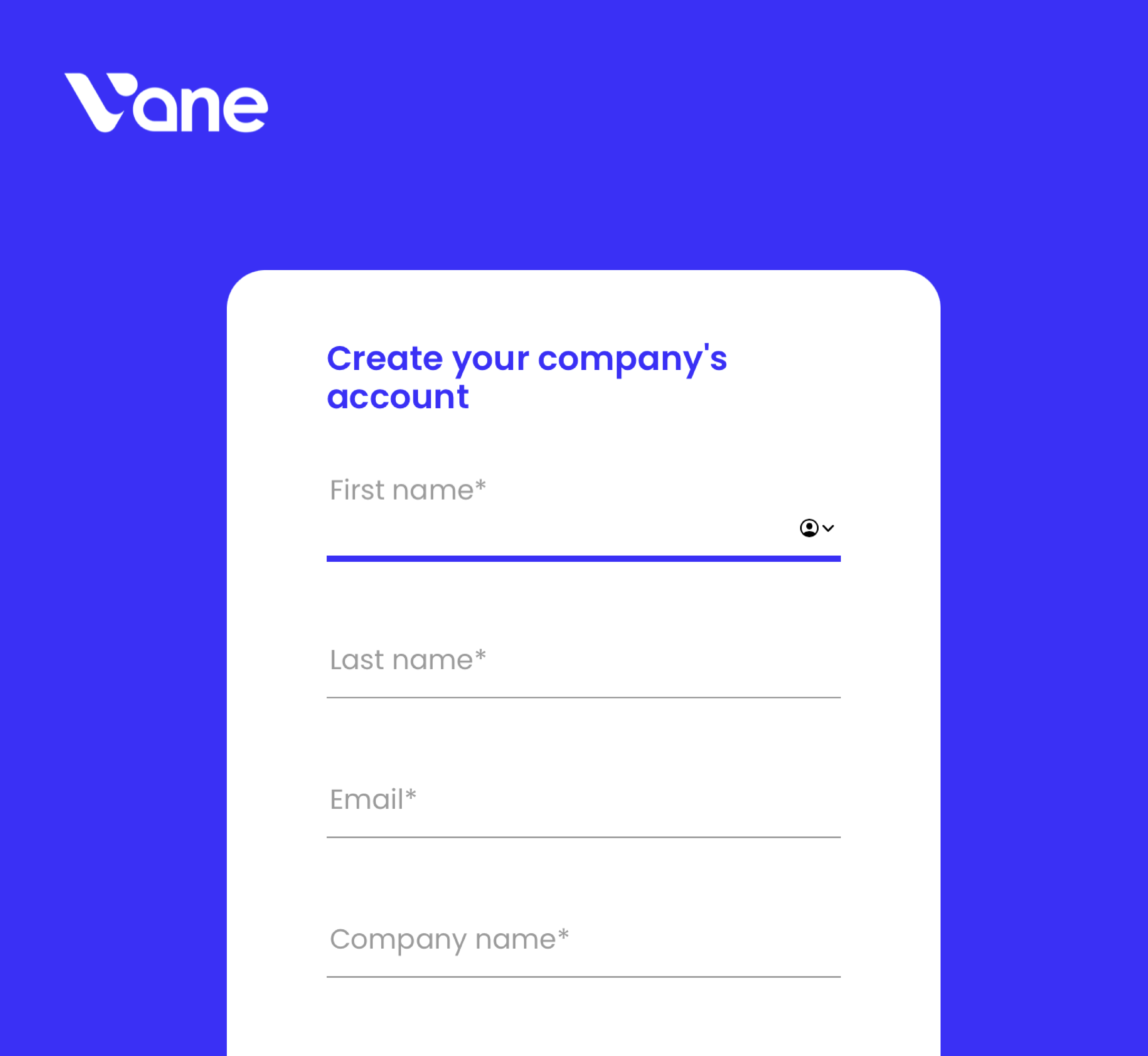

1. Get Started

Get Started here: https://app.vane.capital/customers/sign_up

Fill in all the information and click on Submit.

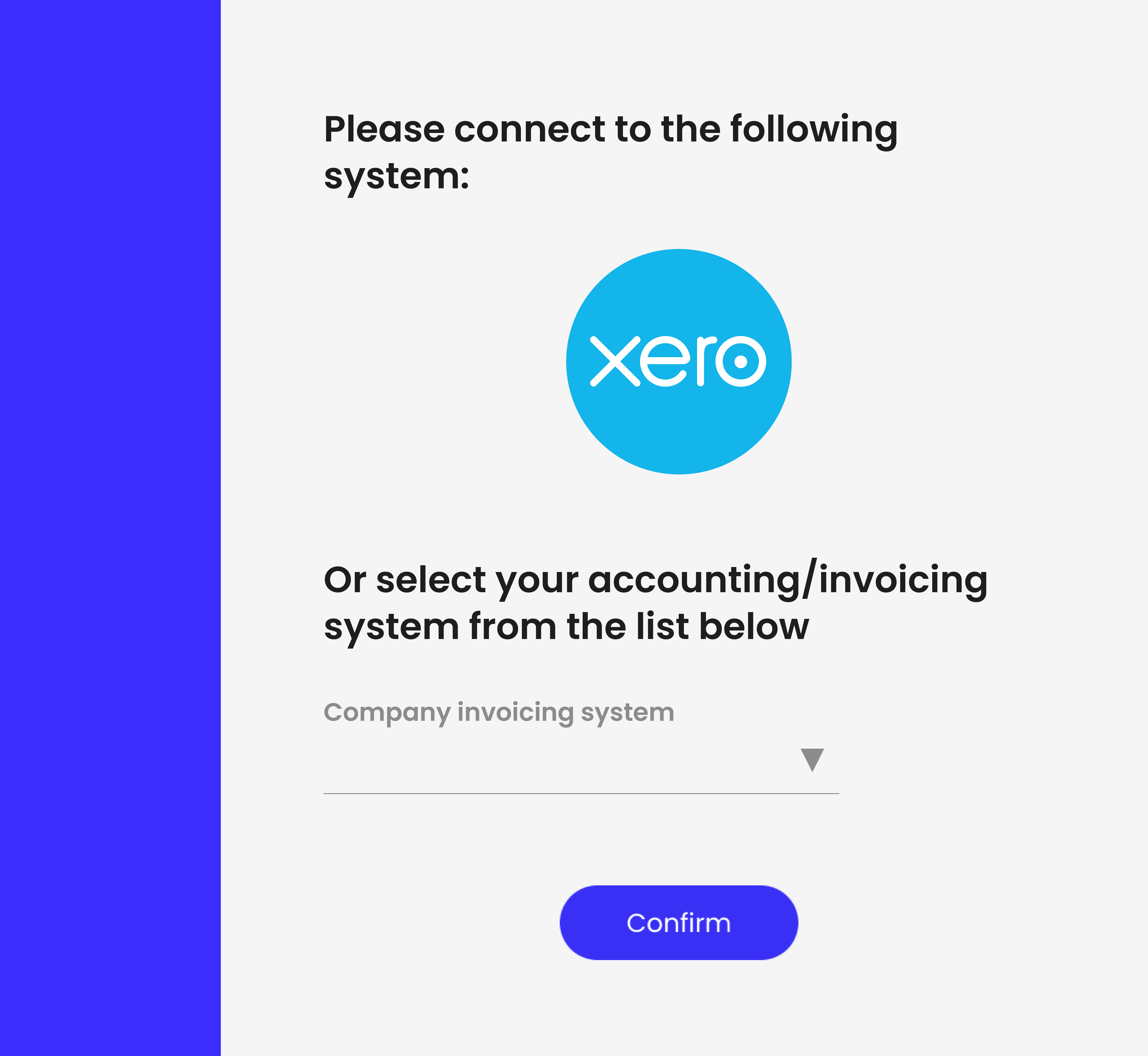

2. Connect to Xero

Xero will be selected by default. Click Confirm.

3. Log In and Authorise Vane

Log in with Xero, and authorise Vane to access your Xero data.

You will be re-directed back to Vane.

Vane - Xero Workflow

When you sign up to Vane from Xero, we automatically create a ‘Vane’ contact in Xero and use this to book the transactions. During the signup process, we get the information on the expense account and the bank account to book the transactions.

Payout

When Vane makes a new payout, the first thing we do in xero is create a new bank account, for the currency in which the payout is made. For example, if the payout currency is EUR, then the bank account name would be ‘Vane’. Then we book the transactions under this virtual bank account.

Below, you will find the guidelines concerning the format of the invoice CSV file.

Let’s look at this with an example. Let’s say the bank selected during the signup process is HSBC. Vane makes a payout of EUR 10,000 to the HSBC bank account of the customer. The fee charged for the EUR 10,000 payout based on a 60-days advance is 2%. Since the currency is EUR, a Vane bank account will be created in xero. This is a virtual bank account.

There will be two entries in the Vane bank account

- Spend Money transaction for the Fee - EUR 200, The transaction date for this entry would be the date when the advance matures

- A bank transfer of EUR 10,000 from Vane to HSBC.

Repayment

Every repayment we receive will be a bank transfer from HSBC to Vane bank account.

Rollover

For an advance to be rolled, the previous fee for the maturing advance has to be paid. Hence the fee payment will be a bank transfer from HSBC to the Vane bank account. The new fee amount will be a Spend money transaction in the Vane bank account.

How reconciliation works?

Reconciliation of transactions is done manually.

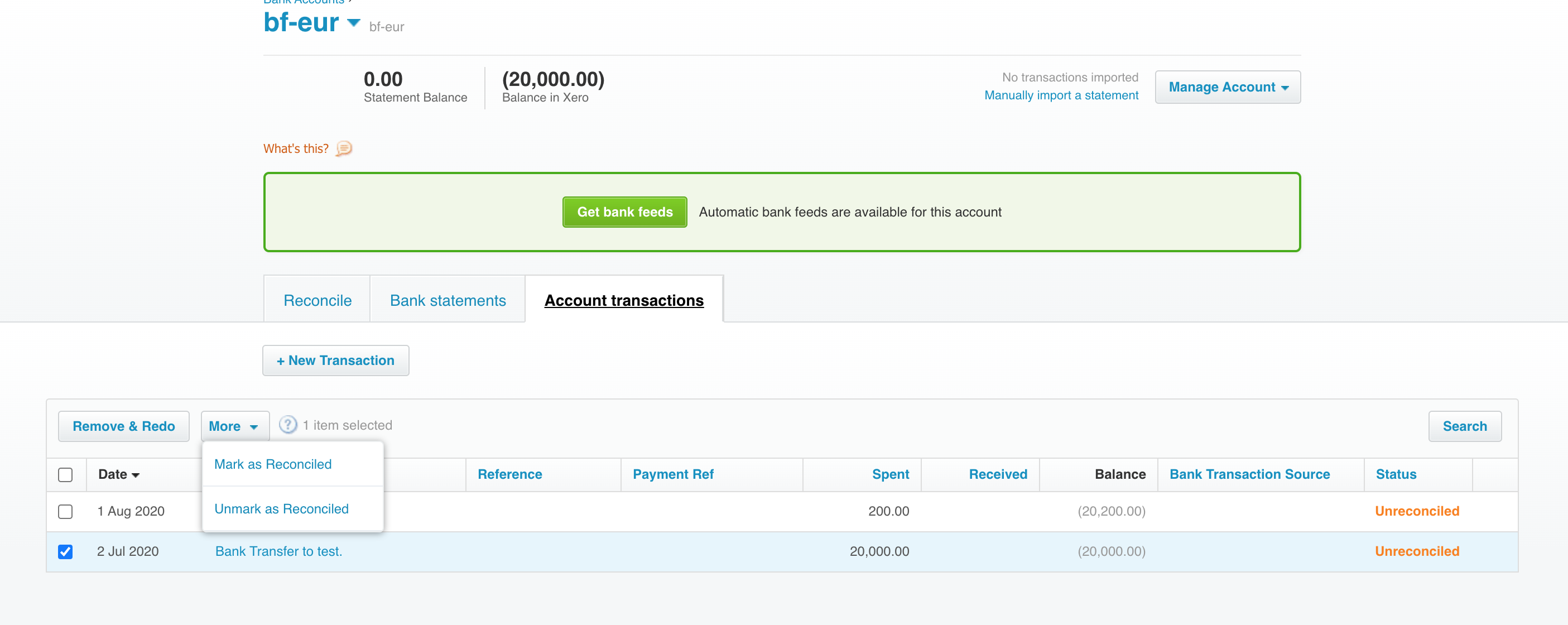

Payout

- Once the payout is done and transactions are in the Vane bank account.

- Once you make sure the amount is in your (HSBC in our example) bank account. Select the bank transfer , click on more and select Mark as Reconciled from the dropdown.

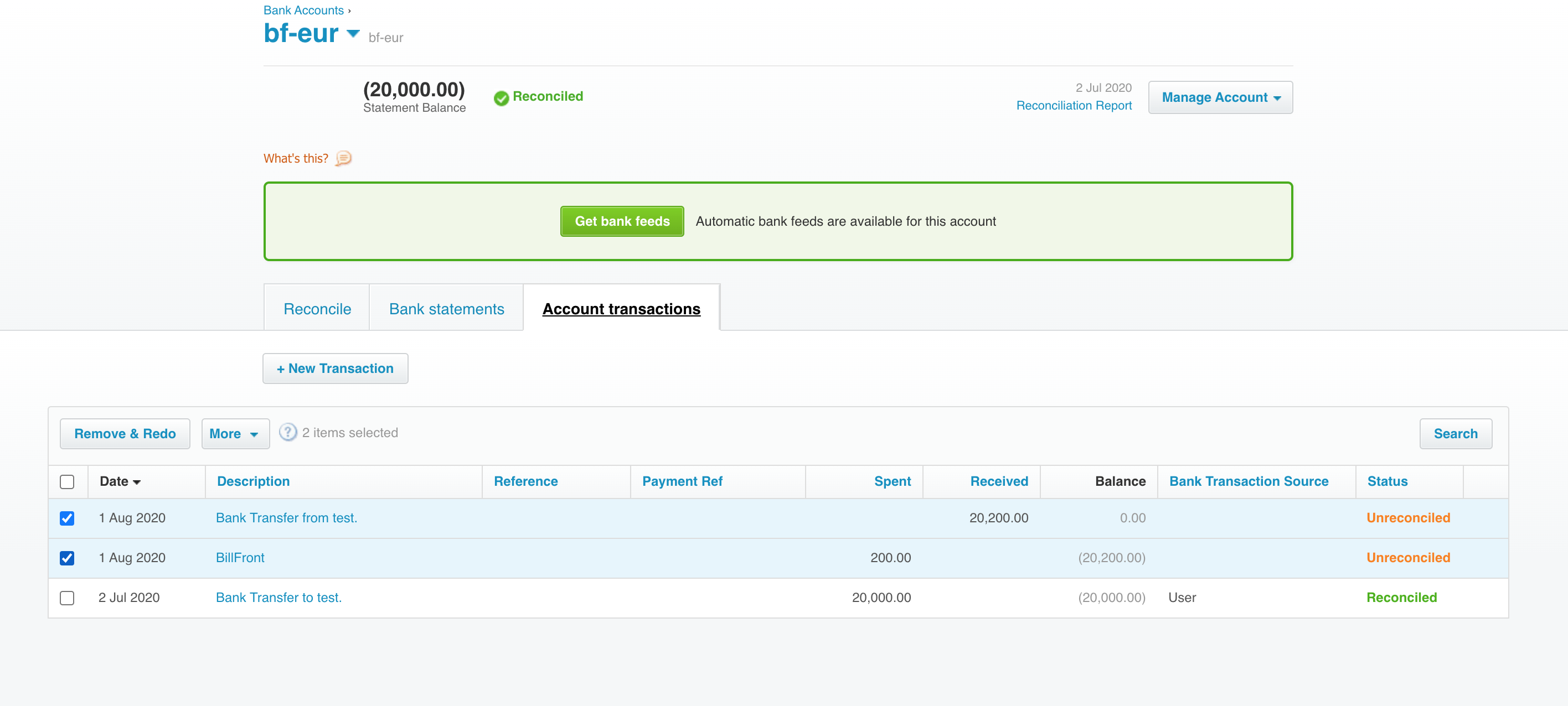

On Repayment

- Once the principal is repaid and the fee is paid to us, there will be a bank transfer to the Vanebank account.

- Please select the transactions as below, click on more and then Mark as Reconciled

Get in touch to learn more about our services and how we can boost your business.

We promise to get back to you within 48 hours.

Site Map

Legal & Privacy

Get Connected

'Vane' and 'Vane Financial' are trading styles. Vane Finance Technology Limited is a company registered in England and Wales (Company No: 9446187) and is registered in the UK with the Financial Conduct Authority reference 09446187. Vane Finance Technology Inc. is registered in the State of Delaware and operates under a California Financing Law license. Our Headquarters is Vane GmbH (HBR 162057 B), registered in Berlin, Germany.

Copyright © 2021 Vane (Group). All Rights Reserved.